Lifetime allowance

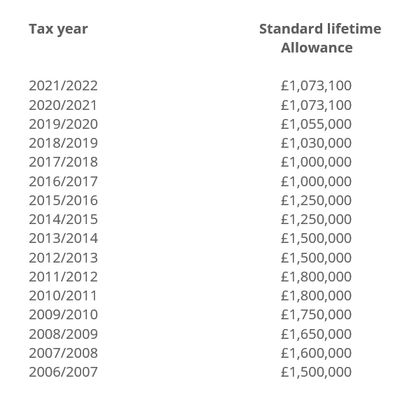

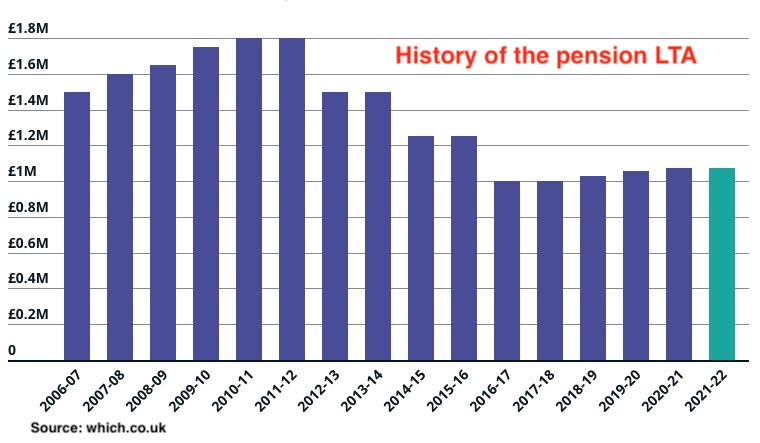

Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. After being introduced in April 2006 at 15mn.

Pensions Lifetime Allowance Devaluation Continues Jackson Toms

Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax.

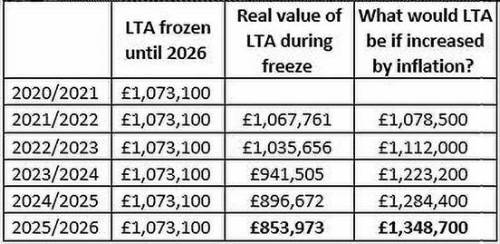

. Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. The government limit is set at 1073100. Web The lifetime allowance LTA on tax-free pension savings will rise as well as the 40000 cap on annual pension contributions the Daily Mail reported citing.

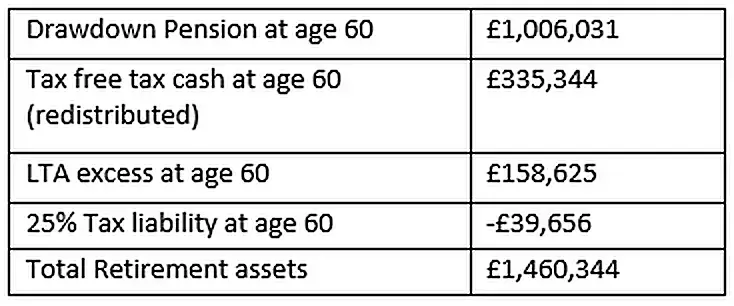

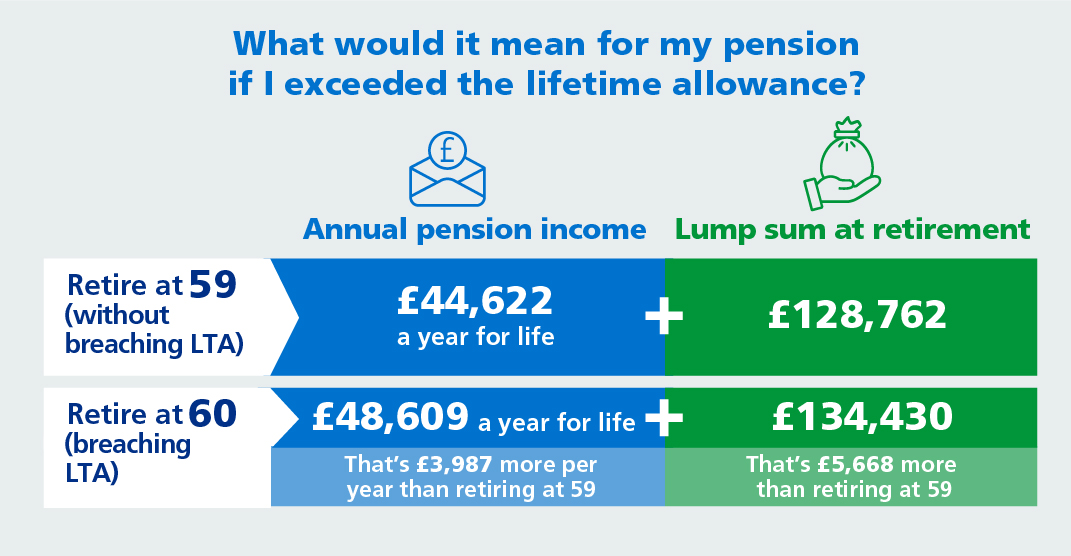

Your pension provider or administrator should deduct. The other is the annual allowance and. Web Charges if you exceed the lifetime allowance Lump sums.

Web The Lifetime Allowance LTA is the limit on the amount you can take from your pension savings before youre charged tax. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge.

Ad Edit Fill eSign PDF Documents Online. Individuals whose total UK tax relieved pension savings are. Web 2 days agoCurrently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m.

Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected. If you take the excess as a lump sum its taxed at 55. Mr Hunt will outline his Spring.

Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. You can save as much as you want to in your pension - but if it exceeds a total amount you could be hit with a. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply.

Web The Lifetime Allowance LTA is the overall amount of pension savings that you can have at retirement without incurring a tax charge. Each time you take payment of a pension you use up a percentage of. Benefits are only tested.

Best selling funds and trusts of 2023. The lifetime allowance limit 202223 The 1073100 figure is set by. Web The lifetime allowance is the total value of all pension benefits you can have without triggering an excess benefits tax charge.

Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. The current standard LTA is 1073100.

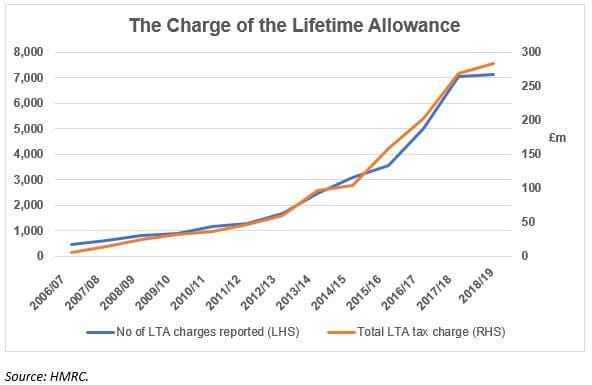

Web 1 day agoThe lifetime allowance has been hit by a series of cuts and freezes by the government since it peaked at 18mn. Web 1 day agoThe lifetime allowance is abolished and annual cap is hiked to 60000 but theres a tax-free lump sum catch. Professional Document Creator and Editor.

Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year. Web What is the pension lifetime allowance in 2022-23. Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits.

Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax.

Pension Lifetime Allowance Explained St James S Place

Jyifsf935h0sym

Understanding The Lifetime Allowance

Nhs England Understanding The Lifetime Allowance

Lifetime Allowance Finsgate

Vor1 Yvxwa2uqm

Pension Lifetime Allowance Cuts On The Horizon Chase De Vere

The Pension Lifetime Allowance And Lifetime Allowance Charge Explained Youtube

Pension Lifetime Allowance Fixed Protection W1 Investment Group

Everything You Need To Know About Your Pension Allowance Wealthify Com

5oje2ctnqs Fwm

Mvjjlrplu1aatm

Pension Lifetime Allowance Explained Get Lifetime Allowance Strategies

Gssj1uzewwuosm

Lifetime Allowance Charge Royal London For Advisers

How To Cope With The Lifetime Allowance Aj Bell Investcentre

How Will The Lifetime Allowance Affect My Uk Pension If I Live Overseas Sjb Global Financial Pension Experts